These tools can highlight anomalies and provide predictive insights, enabling proactive management of receivables. For example, machine learning algorithms can analyze historical data to forecast future bad debt trends, allowing businesses to adjust their strategies accordingly. Businesses in industries with significant is allowance for doubtful accounts a permanent account seasonal variations, such as retail or tourism, may notice spikes in uncollectible receivables during certain periods. Analyzing these seasonal trends allows companies to anticipate and prepare for potential cash flow challenges, ensuring they maintain sufficient liquidity during peak times of bad debt occurrences.

Accounting for the Allowance for Doubtful Accounts

However, the company is owed $90,000 and will still try to collect the entire $90,000 and not just the $85,200. The allowance for doubtful accounts is also known as the allowance for bad debt and bad debt allowance. You should review the balance in the allowance for doubtful accounts as part of the month-end closing process, to ensure that the balance is reasonable in comparison to the latest bad debt forecast.

Allowance for Doubtful Accounts: Components and Financial Impact

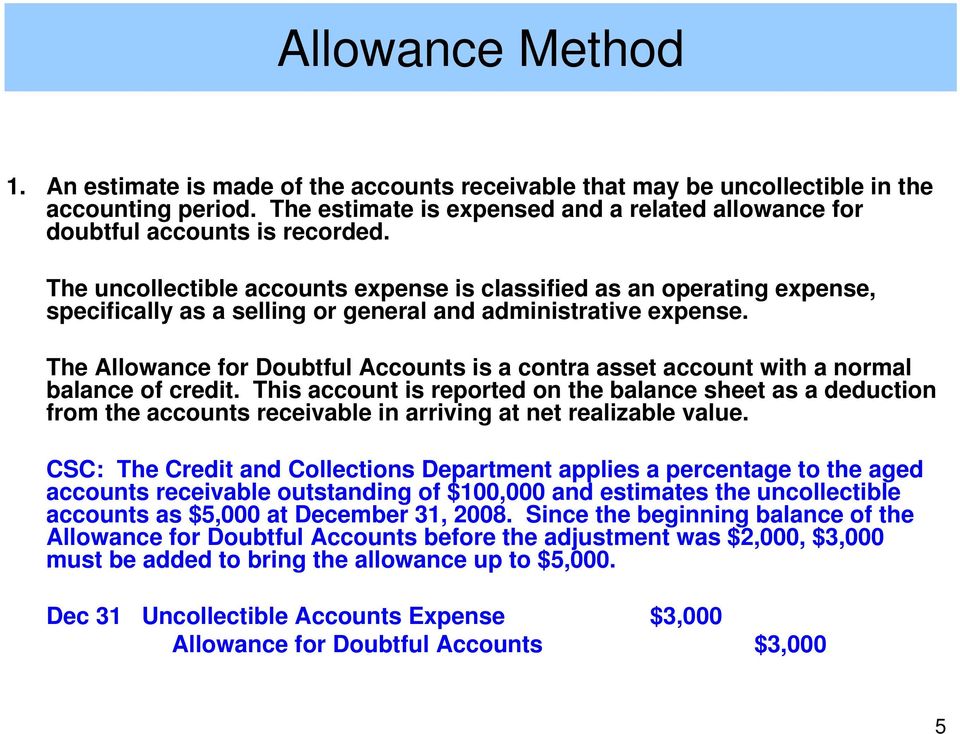

In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. The accounts receivable aging method uses your company’s accounts receivable aging report to determine the bad debt allowance. In the percentage of sales method, the business uses only one percentage to determine the balance of the allowance for doubtful accounts. This variance in treatment addresses taxpayers’ potential to manipulate when a bad debt is recognized.

Estimation by Historical Percentage

- In other words, doubtful accounts, also known as bad debts, are an estimated percentage of accounts receivable that might never hit your bank account.

- There are various methods to determine allowance for doubtful accounts, each offering unique insights into the potential risks your accounts receivable might carry.

- The purpose of doubtful accounts is to prepare your business for potential bad debts by setting aside funds.

This deduction is classified as a contra asset account, so it is paired with and offsets the accounts receivable line item. The allowance represents management’s best estimate of the amount of accounts receivable that will not be paid by customers. It does not necessarily reflect subsequent actual experience, which could differ markedly from expectations.

Accountants use allowance for doubtful accounts to ensure that their financial statements accurately reflect the current state of their receivables. When you create an allowance for doubtful accounts, you must record the amount on your business balance sheet. The doubtful accounts will be reflected on the company’s next balance sheet, as a separate line. Recording the amount here allows the management of a company to immediately see the extent of the expected bad debt, and how much it is offsetting the company’s account receivables. Doubtful accounts are considered to be a contra account, meaning an account that reflects a zero or credit balance. In other words, if an amount is added to the “Allowance for Doubtful Accounts” line item, that amount is always a deduction.

Accounting for Allowance for Doubtful Accounts

Now that you have got a grasp of what an allowance for doubtful accounts is and why it’s vital for your financial strategy, let’s understand how to calculate it. Your allowance for doubtful accounts estimation for the two aging periods would be $550 ($300 + $250). Let’s use an example to show a journal entry for allowance for doubtful accounts. The doubtful account balance is a result of a combination of the above two methods. The risk method is used for the larger clients (80%), and the historical method for the smaller clients (20%).

Review the largest accounts receivable that make up 80% of the total receivable balance, and estimate which specific customers are most likely to default. Then use the preceding historical percentage method for the remaining smaller accounts. This method works best if there are a small number of large account balances. Technological advancements have made trend analysis more accessible and precise. Modern accounting software often includes analytics tools that can track and visualize changes in doubtful accounts over time.

The allowance for doubtful accounts is recorded as a line item on a company’s balance sheet. The allowance for doubtful accounts plays a significant role in shaping a company’s financial statements, particularly the balance sheet and income statement. By adjusting the accounts receivable to reflect potential uncollectible amounts, businesses present a more realistic view of their financial health. This adjustment ensures that investors and stakeholders are not misled by inflated asset values, fostering greater transparency and trust.